Clinical Innovations in Cardiovascular Health:

R&D Methodologies in Pharmaceutical and Device-Based Care

Nick Parry, M.B.A.

Duke University Fuqua School of Business

Introduction

Since the advent of implantable cardiovascular devices in 1970, the pace of innovation has only accelerated. Cardiac rhythm management devices (CRM), pacemakers and defibrillators, have been particularly impactful for the lives of hundreds of thousands of patients suffering from various heart ailments. In the first 15 years following the first ICD prototype being tested in a lab, fewer than 850 patients worldwide received CRM devices to treat sudden cardiac arrest. Less than 10 years later, the CRM implant rate in Europe alone reached 155 devices per million inhabitants every year. Today, the combined revenues stemming from CRM device sales exceed $13.7 billion and are projected to grow at roughly 7% annually for the next five years.1

Given the size and growth of the CRM market, it’s no surprise that larger medical device companies have become more willing than ever to in-license or acquire companies making meaningful change in the space. Perhaps even more so than pharmaceutical players in CVD, growth by acquisition appears to be the predominant model for sourcing R&D expertise and, by extension, innovative approaches to managing and treating CVD. This chapter will focus on how acquisitions of innovative smaller companies by larger firms drive innovation in this sector.

Much of this chapter will explore two companies, Boston Scientific and MyoKardia — one biopharmaceutical-focused and one device-focused — that have come to the fore recently as innovators with the potential to effect massive change in the treatment of cardiovascular illness. Although strategic choices relating to how to bring an effective treatment to market vary slightly between these two case studies, both appear to have struck the proper balance between prioritizing the clinical need for innovative solutions and the implied financial risks of developing solutions for CVD.

Case Study: MyoKardia Inc. and MYK-461 (Mavacamten)

Cardiomyopathy is a disease that hinders the heart from pumping blood and can lead to heart failure. Treatment protocols for the illness focus on encouraging behavioral and lifestyle changes in the patient, according to the American College of Cardiology/American Heart Association’s heart-failure guidelines for the treatment of cardiomyopathy. Although changes in lifestyle have been demonstrated to be highly effective2 in compliant patients, the systemic costs of implementing and maintaining lifestyle-based treatment protocols have been a huge barrier to improving outcomes for patients with various forms of cardiomyopathy. Pharmaceutical treatment options such as diuretics, beta blockers and various enzyme inhibitors have also been found to be effective in managing symptoms for patients with cardiomyopathy — principally aimed at preventing heart failure — but there is currently no approved pharmaceutical option that halts the progression of heart-wall thickening commonly observed in patients with cardiomyopathy.

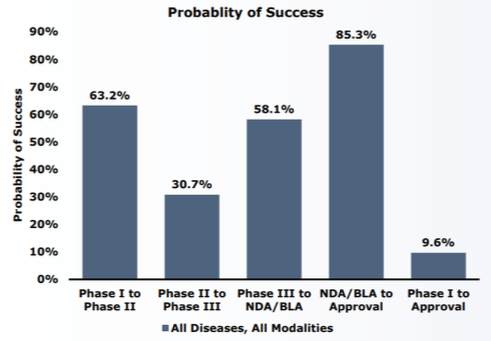

In 2012, a company funded by Third Rock Ventures and led by experts in cardiomyopathy aimed to develop targeted therapies for patients with genetic predispositions to developing this illness. An initial investment of $93 million from Third Rock provided the seed capital to begin development of MyoKardia’s first compound: MYK-461.3 A venture capital (VC) investment of this size in a cardiology-focused company has become exceedingly rare, with total novel drug funding by VCs having declined over 33% since 20134 Less than five years after the company’s incorporation, the FDA granted MYK-461 (mavacamten) Orphan Drug Designation for the treatment of symptomatic obstructive hypertropic cardiomyopathy.5 This incredible achievement in such a small amount of time is the direct result of a critical innovation in MyoKardia’s R&D process: using phenotyping to identify mutated molecular pathways that a targeted therapy can directly treat. 6 The use of big-data technologies early in the drug development phase not only allowed MyoKardia to present mavacamten efficacy data earlier in the process, but also attracted interest from Sanofi’s Sanofi-Sunrise group — a venture- focused arm of the pharmaceutical company’s R&D department aimed at co-developing innovative treatments originating in academic labs and startups.7 (See Appendix 1 for details on probability of success by phases of development.)

Acquiring innovations from smaller startups and establishing licensing deals with these partners has become a hallmark of big pharmaceutical companies’ operating models.8 At the time of Sanofi’s investment, MyoKardia’s pre-money valuation stood at about $292 million.9 Sanofi’s $150 million equity financing and an additional $45 million in committed capital to fund R&D at MyoKardia provided the runway needed to get through phase 3 clinical trials and helped finance further drug development through 2020. In late 2015, MyoKardia’s initial public offering priced the firm at $264 million, but less than 18 months later, with mavacamten’s designation as an orphan drug, the firm’s market capitalization grew to over $1.8 billion.10 For a company whose entire portfolio of products addresses the needs of fewer than 1.5 million people suffering from various heart-failure-related conditions, and which has no commercially available drugs on the market as of yet, this amount of value creation before any real revenues have accrued to MyoKardia is staggering. The market has clearly identified MyoKardia as a shining star in clinical innovation: stemming their commitment to using cutting-edge science in genomic modeling, combined with their focus on clinical “white space“ of highly complex diseases with unmet clinical need for innovation. In sum, MyoKardia is a unique example that can serve as a model for other startups in this space. Its big-data capabilities coupled with innovation in drug discovery allowed MyoKardia to differentiate itself and attract significant investment.

Cardiovascular Disease R&D: Implantable Cardioverter Defibrillators (ICDs)

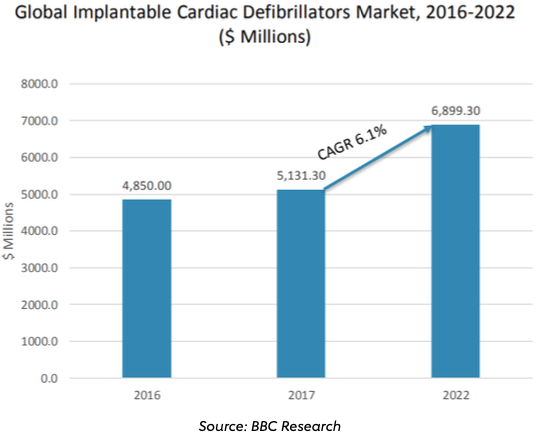

As of 2015, over 370,000 patients received cardiac device implants for pacemaking or rhythm management, generating over $5 billion in sales (Appendix 2).11 Currently, five players control over 90% of the ICD market: Medtronic, St. Jude Medical, Boston Scientific, the Sorin Group and Biotronik, with nearly over 40% of total market sales accruing to Medtronic through 2016.12Innovations such as the 2016 FDA approval of Medtronic’s MRI-safe ICD device have bolstered the firm’s continued relevance, but Boston Scientific’s introduction of a device able to be implanted subcutaneously (S-ICDs) presents one of the more significant innovations to take place in the ICD space in over a decade.

Case Study: Boston Scientific, Cameron Health and Subcutaneous ICD

In 2000, two physicians — Gust Bardy and Riccardo Cappato — founded Cameron Health around a concept for an entirely subcutaneous ICD that would drastically improve patient safety and potentially decrease the total cost of care for treating patients suffering from sudden cardiac arrest (SCA). The principle of their design was to have a device that could be implanted just below the patient’s skin, without the need for transvenous leads, which are significantly more complicated to install and very difficult to re-install should one of the leads fail.13 Further, the procedure for installing leads subcutaneously obfuscated the need for fluoroscopy during the installation, and the entire process could be completed in one day, saving hospitals, patients and payers both time and money by not requiring an overnight stay for observation and avoiding expensive imaging procedures.14

Initial R&D of Cameron Health’s S-ICD system took place between 2001 and 2004, with the first short-term trials being conducted at six academic trial sites on 78 patients indicated for SCA and eligible for ICD-based treatment. Initial funding for Cameron Health was secured through two VC funds in January 2001: Sorrento Associates and Versant Ventures.15 Just over a year after this first $3.5 million round, Cameron secured nearly 10 times this amount with debt financing funded by an additional three VCs who had become aware of Drs. Bardy and Cappato’s trial.16

When the first round of preclinical results proved efficacy when compared to pre-existing ICD technologies for the treatment of SCA,17 Cameron Health issued its first equity round in October 2005. Included in this equity round was a new strategic partner: Boston Scientific. Boston Scientific’s expertise in cardiac device development and marketing would provide a strategic advantage to Cameron’s efforts to commercialize its ICD device after FDA approval. Included in Boston Scientific’s term sheet with Cameron Health was a right-of-first-refusal to buy out Cameron Health in the event of an eventual FDA approval.18 By adopting a milestone-based funding model with Boston Scientific, Cameron Health had virtually guaranteed fiscal solvency throughout the rest of the R&D process. Over the following six years, Cameron Health was able to attract an additional $250 million in equity financing through various venture capital funds before its eventual acquisition by Boston Scientific in 2012.19

Cameron Health’s S-ICD platform was revolutionary not just in its ability to deliver results similar to those of prior platforms in a far safer way, but also in the sense that it had presented the market with a cost-effective solution for treating a complex illness at a time when payers and policymakers have become more focused than ever on finding less costly solutions to deliver quality care.20 Although the introduction of a lower-cost solution for patients suffering from SCA was in no way a guiding influence for Cameron Health and Boston Scientific throughout the development process, it does serve as a seminal case of a health care innovator proving that solutions with increased safety and equivalent efficacy can be delivered in a cost- effective manner. In this way, Cameron Health’s innovation benefited from an environmental “boost“ of releasing a cost-effective alternative to payers who are increasingly forcing hospital systems and physicians to consider the economics of patient care.

Conclusion

The landscape for R&D innovation throughout cardiovascular health has been challenging in recent years. Rising costs of clinical trials combined with an environment where institutional money has shifted focus away to higher risk-reward disease groups pose an ever-present challenge to companies looking to shape the future of CVD treatment. This challenge, combined with the consistent clinical need for novel treatment pathways in a disease class that affects millions globally each year, requires continued clinical and institutional focus. As both device and pharmaceutical companies explore new means of funding R&D and delivering truly life-saving treatments to market, it has become apparent that partnership between established global manufacturers and marketers and smaller innovators is critical to ultimately delivering successful innovations to market.

Partnerships like these will necessitate the willingness to collaborate, a steadfast commitment to sharing intellectual property among clinicians, partnered entities and capital providers. With a continued focus on delivering safe, effective and cost-conscious solutions to the market, the future of innovation within cardiovascular R&D could be quite bright indeed.

Appendix 1: Phase transition success rates and LOA from Phase 1 for all diseases, all modalities

Appendix 2: Global Implantable Cardiac Defibrillators Market

Endnotes

- BCC Cardiovascular Global Market Report, 2019

- D.L. Katz, “Lifestyle Changes vs. Medication: When Each Is Right,“ Huffington Post, November 17, 2011. https://www.huffingtonpost.com/david-katz-md/health-and-nutrition-life_b_610128.html

- Series A terms sourced from PrivCo data. https://www-privco-com.proxy.lib.duke.edu/private- company/MyoKardia-inc

- D. Thomas and C. Wessel, “Venture Funding of Therapeutic Innovation,“ BIO: Biotechnology Industry Organization, February 2015. https://www.bio.org/sites/default/files/files/BIO-Whitepaper-FINAL.PDF

- http://www.MyoKardia.com/programs.php

- T.J. Povsic et al., “Navigating the Future of Cardiovascular Drug Development —Leveraging Novel Approaches to Drive Innovation and Drug Discovery: Summary of Findings from the Novel Cardiovascular Therapeutics Conference,“ Cardiovascular Drugs and Therapy 31 (2017): 445. https://doi- org.proxy.lib.duke.edu/10.1007/s10557-017-6739-9

- https://www.cnbc.com/2018/03/26/big-pharmas-scramble-to-invest-in-start-ups-to-fuel-innovation.html

- Ibid.

- Deal terms sheet sourced from PrivCo data.

- https://www.cnbc.com/2018/03/26/big-pharmas-scramble-to-invest-in-start-ups-to-fuel-innovation.html

- B. Joshi, “Cardiovascular Surgical Devices: Technologies and Global Markets. “ BCC Research HLC076C, September 2016.

- Ibid.

- G.H. Bardy et al., “An Entirely Subcutaneous Implantable Cardioverter-Defibrilator,“ New England Journal of Medicine 363 (2010): 36-44.

- J. Lee, “Alternative Heart Therapy: Defibrillator is Less Invasive, Called Cost-Effective.“ Modern Health Care 42, no. 44 (2012): 12.

- PrivCo term sheet filings. https://www-privco-com.proxy.lib.duke.edu/private-company/cameron-health

- Ibid.

- Bardy, et al., “An Entirely Subcutaneous.“

- “Cameron Health Commences Clinical Trials of the Minimally Invasive Totally Subcutaneous Implantable Defibrillator for Treatment of Sudden Cardiac Arrest,“ Cardiovascular Business Week, Atlanta, January 20, 2009: 32.

- Funding data from PrivCo. https://www-privco-com.proxy.lib.duke.edu/private-company/cameron-health

- Lee, “Alternative Heart Therapy.“

-

-

Driving Innovation

-

Innovations in Cardiovascular Health

-

The Role of Physicians in Driving Innovation

-

The Role of Patient Groups in Driving Innovation

-

Clinical Innovations in Cardiovascular Health

-

What Drives Innovation in CV Health?

-

The Rise of Academic and Contract Research Orgs

-

Federal Regulations as Accelerators

-

Reimbursement Models

-

Consumer Technology

-

Training Cross-Disciplinary Innovators

-

Conclusion